How to put expenses in quickbooks | Call on Quickbooks tech support number:-+18772499444

How to put expenses in Quickbooks

The other side to this is it is tedious and a similar fundamental capacity (paying a bill) can be accomplished by simply entering a register with QuickBooks when an installment is dispatched. The most independent company that I manage really does this very thing. To them, it's not worth the time and pushes to enter similar costs they know and see every month in the Enter Bills window. They set up an ACH with most sellers and will enter the cost into QuickBooks when it hits the bank. This can even be additionally computerized by utilizing a retained exchange for settled costs each month.Quickbooks tech support number:-+18772499444 be that as it may, in case you're an eatery the measure of sellers can be overpowering. Every has their own particular time allotment (Due on receipt, Net-30, and so on.) when the installment is late, send different bills through the span of the month with fluctuating sums, and transmit month to month articulations with a diagram of the considerable number of bills sent for that specific month which can be inspected by means of merchant focus. Try not to go nuts, however, QuickBooks helps handle this procedure in a smooth way

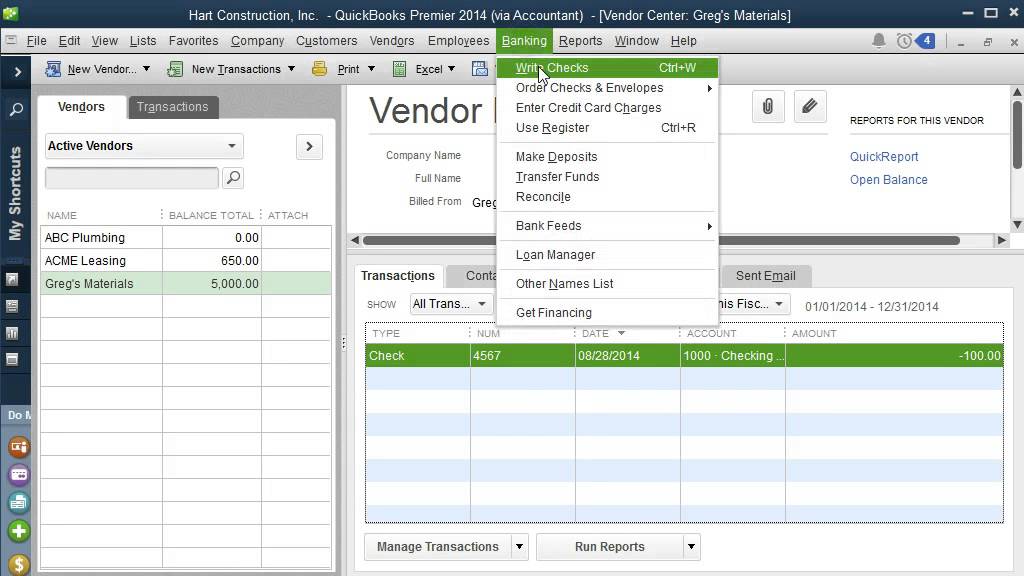

A capacity in QuickBooks I regularly observe ignored or totally abused is the Enter Bills and the consequent Pay Bills work in QuickBooks. Both are awesome capacities that give an

outline of what the organization's aggregate liabilities are to sellers when they're expected, and the capacity to print or even pay them online through QuickBooks. In this two section post we'll talk about the way toward entering bills and after that, we'll discuss how to appropriately pay the bill by means of the Pay Bills window.

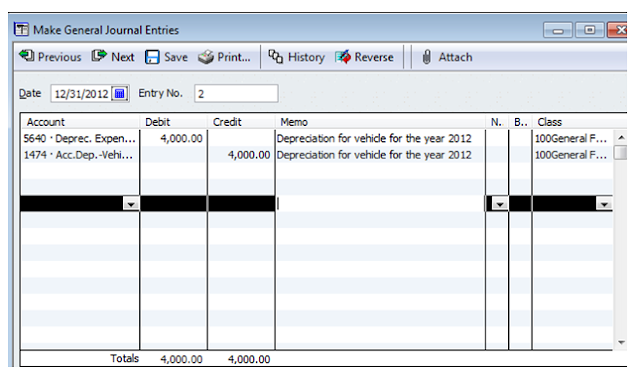

How QuickBooks Handles Bills - The bookkeeping behind entering and paying a bill is as per the following:

The bill is entered which increment your cost record and increment

your Accounts Payable (obligation)

The bill is paid which diminishes your Accounts Payable and reductions your checking (money) or exchanges the risk to a charge card

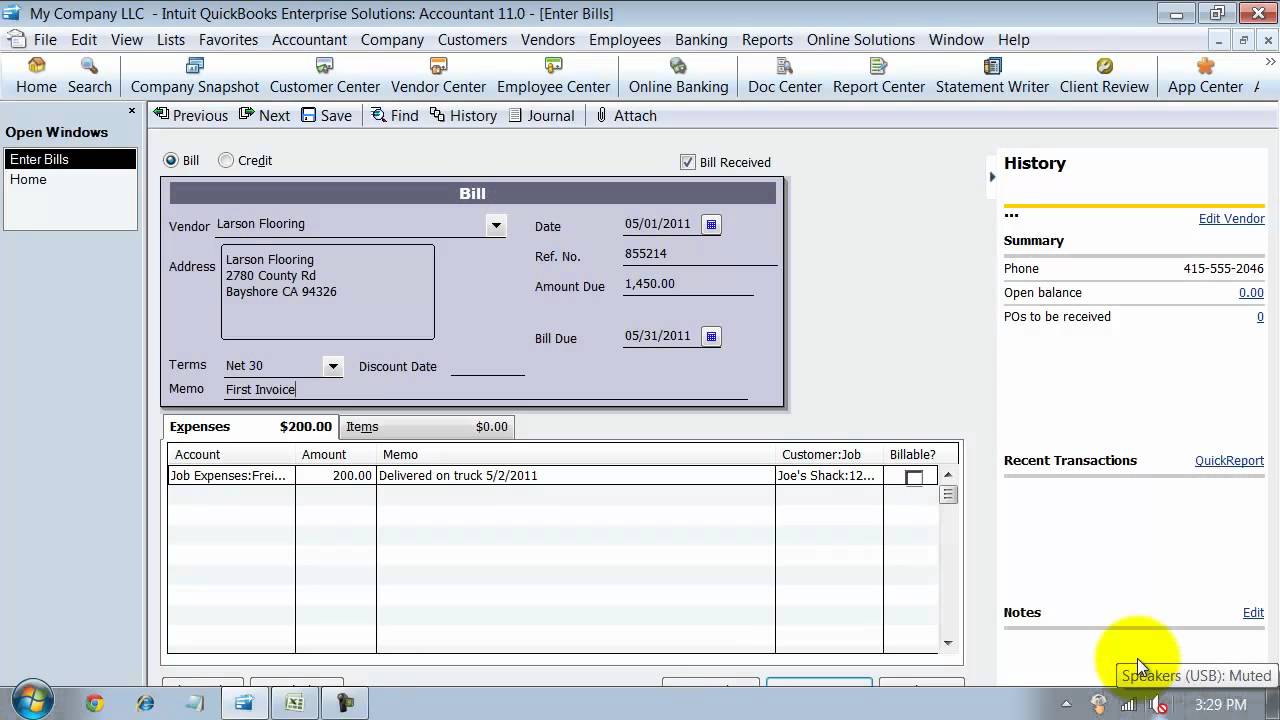

Step by step instructions to Enter Bills - When you get a bill from a seller be it a printed copy or computerized record from an email or site you're keen on some data to enable round out the bill to pay window:

The Vendor (Make beyond any doubt the address data is filled ineffectively)

(Date the bill was made by the merchant)

Receipt # Quickbooks tech support number:-+18772499444

Sum Due (The aggregate sum due for administrations rendered

Terms (what number days have given before it's expected, this could be expected on receipt or Net 30)

Reminder (To note what the bill was utilized to pay for)

When you have the majority of the relating data rounded out in the purple bill box you have to then assign it to the best possible cost or resource account beneath. Allude to your CPA for the limit that they might want to see a cost turn into an advantage.

Entering bills can be tedious and as examined before should not have to be in your organization's deck of cards. In the event that any way you're getting products bills from a plenty of sellers entering bills into QuickBooks helps hold your records payable under tight restraints, considers your merchants responsible for credits issued, and gives you a major photo of your aggregate liabilities to your merchants at any one offered time to help gauge your income

Instructions to Enter Credits - If you've overpaid a receipt or a discount is expected a seller will issue and a worthy representative of your organization. Much the same as in the above illustration we require the merchant, credit sum, date, and the related reference number. To enter the credit window tap the radio catch in the upper left corner of the Enter Bills window. Enter the merchant, date of the credit notice, relating reference number, and the sum.

At the point when a credit is issued a few people ponder what account they're assumed to hit. All things considered, if a merchant was to discount your cash for a protection cost since you overpaid the exceptional you essentially back the cost out of the protection cost, this isn't paid!

Twofold Checking with Statements - If a seller is sending different bills or can possibly send various bills over the whole month an announcement is produced a month to month premise asking for the installment to be transmitted for the referenced bills right now due. I never utilize the announcement as methods for dispatching installment. On the off chance that I've been doing my activity right, I will have the greater part of the bills in QuickBooks referenced to the announcement. I utilize the announcement then as a method for accommodating my remarkable bills.

I first head into seller focus, select the merchant, at that point survey the bills referenced in the announcement. On the off chance that you've been entering each bill in with the majority of the appropriate data you can sort by the date at that point take after alongside the receipt numbers. I twofold check the majority of the solicitations as credits can be issued that are ignored, a sum can be entered wrong ($654.63 versus $645.63), and you may have quite recently lost a bill. This causes you chief your sellers and keeps your head cool

Now put in the repaid sum and furthermore select the significant client job.Under the bills segment, indicate on the off chance that you need to charge this adds up to your client.If you would prefer not to determine the charge at that point keep the default settings.

These are any costs that a dealer causes for the benefit of its customer which are later on repaid by the customer himself. The case of a repaid cost can be a conveyance expense paid to exchange merchandise from vendor to purchaser. Since your each business exchange should be recorded in the books of records, so are the Reimbursed costs.

Be that as it may, now the inquiry if it's not too much trouble ensure that the cost will, in any case, be accounted for however now won't be charged.

But on the off chance that you need to charge your client for the repayment then checkmark the case close by the option.

Click OK and Save. At the point when this is done then you will have an effective repaid cost inside your QuickBooks platform.

How to receipt the reimbursement?As you have entered the repayment sum now you should need to receipt the same to your client too.

QuickBooks error support As you have as of now check denoted the choice (in the past advance) of having the receipt sent to your customer, however now in what manner will you enact and utilize it. All things considered, that you can do by following the means below: Within your QuickBooks, tap on the solicitations tab. You can find the tab from the clients choice situated on the best route bar.

From the window that will show up, tap on the New client drop-down catch and find Jobs tab.Here tap on the Add cost option.Now pick the reimbursable cost amount.

Now tap on the Hide catch in the event that you would prefer not to charge your customer.Select the markup from the costs tab.Fill in various the important data and hit Ok.

All the data fed in will now be taken up by the receipt. Snap mail the receipt and you will be incited for the info.Feed in the data and affirm. Snap send and the receipt detail will be sent to the client

This is very helphul blog to fix error.Get Instant Support for All Kinds of Technical Issues That Come Up in QuickBooks from Our Experts Who are Well Adept in Resolving Such Issues. Get each moment of consistently QuickBooks Error tech Support Phone Number, Call ☎1-800-961-9635 QuickBooks Error tech Support Phone Number or Get Support through Email and Chat. Fix QuickBooks Errors, Data Transfers, Install QuickBooks accounting Software, QuickBooks Backup, Updates and Much More.

ReplyDeleteWe provide technical help for all of the QuickBooks issues that are users facing. We are Quickbooks Support Phone Number 800-986-4591 deliver solutions taking just a few seconds only. Avail benefits from our support team that is available for you 24*7.

ReplyDeleteExcellent post. Thanks for sharing such great and helpful info with us. Keep it up. I appreciate this informative post. Want to know about QuickBooks Visit here.

ReplyDeleteHow to fix QuickBooks Common Error

Excellent post. Thanks for sharing such great and helpful info with us.Keep it up. I appreciate this informative post.Want to know about QuickBooks Visit here.

ReplyDeleteQuickBooks Error Support